Introduction: What is Crowdfunding?

In any business you need a source of Fund, be it a loan from the bank, savings, venture capitals or investments from entrepreneurs. Often obtaining loans from banks can be inconvenient due to various reasons like the high interest rates, strict lending policies, mortgage issues etc. Crowdfunding is an appropriate solution in such scenarios. Crowdfunding is a method of raising capital through the collective efforts of a large number of people or crowd, hence the naming. Individuals or organizations can invest in or donate to crowdfunded projects in return for a potential profit or reward. In the modern times crowdfunding is carried out primarily online via social media or crowdfunding platforms like Kickstarter, Indiegogo, Realty Mogul, Oporajoy and so on.

What is Crowdfunding in Real Estate?

Although a relatively new method of raising capital for Real Estate investments, Real Estate crowdfunding is gaining popularity all over the globe. Through this type of Real Estate investing, investors are able to invest in a wide variety of properties without having to deal with mortgage brokers, Real Estate agents or contractors.

Previously, obtaining external investments from investors in the Real Estate sector was difficult as it depended mostly on business connections. In many developed countries like the USA, Australia and UAE, after the crowdfunding investment model has been adopted by all, developers can get connected to a large number of investors very easily. On the other hand, Investors can also choose where to invest their money from safe and convenient platforms.

Types of Real Estate Crowdfunding

There are two major types of Real Estate Crowdfunding, namely, Equity (Equity-based) Crowdfunding and Debt (Lending-based) Crowdfunding. Debt-based crowdfunding is also known as peer-to-peer lending. In this type of crowdfunding, investors lend money to businesses like Real Estate developers or other individuals with the expectation getting repaid along with added interest.

On the other hand, Equity crowdfunding is a mechanism that enables broad groups of investors to fund the Real Estate Project in return for equity. That is, investors and business owners have shared ownership of the project and profit is shared according to the investment ratio or as per discussion. The major risk associated with this type of investment is that, since investors have an equity stake in the property, so they can lose money if the value of the Real Estate project decreases.

Donations or Rewards are also a type of Crowdfunding, but this type is not applicable in Real Estate as the investment amount is huge which is not covered by Donations or Rewards. Still, in some countries like Malaysia and Indonesia there are some organizations (e.g. EthisCrowd which is a Singapore based Platform) which, besides Equity Crowdfunding, also operates on Donations and Rewards to finance Real Estate Projects like community houses.

Advantages of Real Estate Crowdfunding

There are many reasons as to why Crowdfunding in Real Estate is gaining popularity. Some of them are listed below:

- Lower Capital Requirement: In the past, in order to invest in a Real Estate, investors would require large amounts of capital to cover the upfront costs. The Real Estate crowdfunding market has enabled non-accredited as well as non-professional investors to get involved without the need for large amounts of capital to get started.

- Accessibility and Freedom: The Real Estate investment market is now far easier to access because, with the help of technology, Real Estate crowdfunding platforms online are very easy to use. It also empowers you to make your own decisions as you can choose how much you want to invest and where you want to invest. You can get access to different platforms and make a comparative study between the best Real Estate developers, thus investing in the best property markets only.

- It is a Worldwide Platform: People from all over the world can invest in a Real Estate property regardless of the currency. And of course, it helps investors browse and invest in properties in countries all over the world.

- Efficient Management: Real Estate has always been an “admin-heavy” business which requires a lot of paperwork. Since most Real Estate Crowdfunding is done online, investment in a property handled by the platform itself. Information is available easily. Thus, with increased efficiency and better transparency, the project duration decreases making the investment more profitable.

Global Real Estate Crowdfunding Market

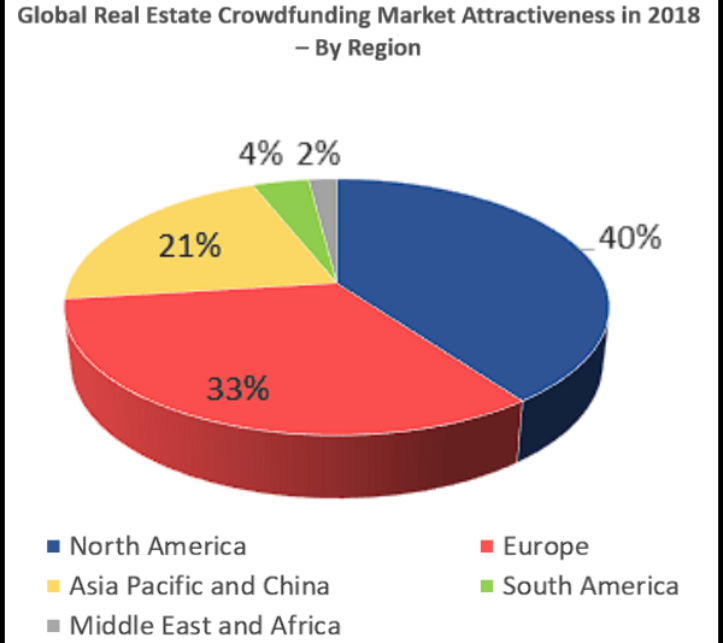

According to the report by “Facts and Factors Market Research” The Real Estate Crowdfunding Market has grown drastically over the years from USD 19.1 million in the year 2012 up to USD 2.57 billion by 2015. Globally the Real Estate Crowdfunding Market is predicted to be worth approximately USD 13.21 billion in 2018, and the market is expected to grow up to a dramatic value of around USD 868.98 billion worldwide by 2027. The pie chart below shows the Global Real Estate Crowdfunding Market Attractiveness by region in 2018.

Let us look into some examples of Crowdfunding in Real Estate in different countries of the World.

- USA: In the Real Estate Sector the largest Crowdfunding Market belongs to the USA. In 2018 the Crowdfunding Real Estate Market was USD 6 billion. All the most known crowdfunding platforms specialized in Real Estate were born between 2010 and 2014 in the USA and the most active platforms are based in California.

On average, half of the selected platforms invests in residential properties only while the other half invests in Real Estate assets with mixed uses (residential, retail, office, industrial etc.)

Most of the platforms requires the investors to provide a minimum amount of capital from USD 100 up to USD 10,000. In terms of active users, it ranges from between 40,000 users and 500,000 users. The returns for investors vary on the basis of the crowdfunding model adopted, on the type of asset acquired and on the timing of the investment.

Some of the well-known USA based Real Estate Crowdfunding platforms are: Fundrise, Patch of Land and Realty Mogul.

- UK: While in the USA the Real Estate crowdfunding business is booming fast both in services and competition, in the newest market of the UK there are many opportunities waiting for bold entrepreneurs. Since April 1st, 2014, every Internet crowdfunding platform in the UK has to comply with the new rules of the Financial Conduct Authority’s (FCA). And one of their rules states that a new investor can invest an amount which is not more than 10% of their net investible assets, that is, of the available money discounting primary residence, pension and life insurance. This is done to protect any novice investors. After two crowdfunding investments the investors are then given full freedom and can invest as much as they like.

Some of the most used Crowdfunding platforms in UK are Property Partner and Property Crowd.

- Australia: CrowdfundUp is the leading Crowdfunding Platform for Real Estate Investment in Australia. CrowdfundUP gives investors online access to premium property development and investment oppurtunities. They are partnered with the best property developers in Australia, those with a proven track record and strong management team.

- Malaysia: In Malaysia, Propnology is a well-known Real Estate crowdfunding platform. Investors can invest with an amount starting from USD 475 only. The investors will earn rental income throughout the investment term and potential capital growth upon disposal. Prop

- Singapore: Propnology also has their platform in Singapore where investors can invest from as little as USD 500.

Another interesting Real Estate Crowdfunding Platform in Singapore is EthisCrowd as they are the world’s first Real Estate Islamic Crowdfunding Platform. EthisCrowd.com is a community of approximately 21,000 individuals from around the word. They also have their business in Indonesia, Malaysia and Dubai. Ethis has helped to develop various Affordable Housing Projects, Subsidized Housing Projects and Commercial Projects.

- UAE: Currently the Dubai Financial Services Authority (DFSA) has regulations concerning crowdfunding in the UAE, and these are focused on debt and equity crowdfunding. Two well recognized Real Estate crowdfunding platforms in Dubai are the Smart Crowd and Durise. While others are Beehive and Eureka.

Real Estate Crowdfunding in Bangladesh

Crowdfunding in the Real Estate Sector is a relatively new concept in the Indian Subcontinent and so in Bangladesh. But there has been a few researches and some surveys which has given promising results. We are already familiar with similar concepts like Group Buying Policies in Real Estate. This Concept some similarities to that of the Equity Crowdfunding.

Research done by Suvastu Properties Ltd. has given insights to most preferred areas in Dhaka City where people want to invest in a group buying apartment project, preferred apartment sizes in those areas and other valuable information.

Conclusion

Although crowdfunding investments in Real Estate is at its emerging stage in many countries it has potential to revolutionize the way in which individuals invest in Real Estate as well as how business raise capitals for their projects. In some countries it is becoming a stand-alone industry. Crowdfunding has also allowed investors to have a voice in the project development process and can be more involved than ever. From the trends seen all over the world, it is safe to say that with a properly designed online platform, backed by a strong and well managed organization, Crowdfunding in Real Estate will take on the market very rapidly in Bangladesh.

References:

- Real Estate Crowdfunding: Introduction to an alternative way of investing

- Global Real Estate Crowdfunding Market: An Overview and Market Investing

- Crowdfunding: what you need to know

- Crowdfunding from fundable.com

- Islamic Crowdfunding – a Global Perspective from Singapore

- Real Estate Crowdfunding – Property Crowdfunding

- Real Estate Crowdfunding Market Size, Share 2019

- The Ultimate Guide to Real Estate Crowdfunding with Examples

- Real Estate Crowdfunding Market by Investors (Individual Investors and Institutional Investors) and By Property Type (Residential and Commercial)